FinancialInclusionThroughDigitalPayments:ReachingBharat

India's financial inclusion journey is one of the most ambitious transformations of our time. Yet, the promise of "Digital India" will only be fulfilled when digital payments reach not just the cities, but the very heart of Bharat - its towns, villages, and underserved communities.

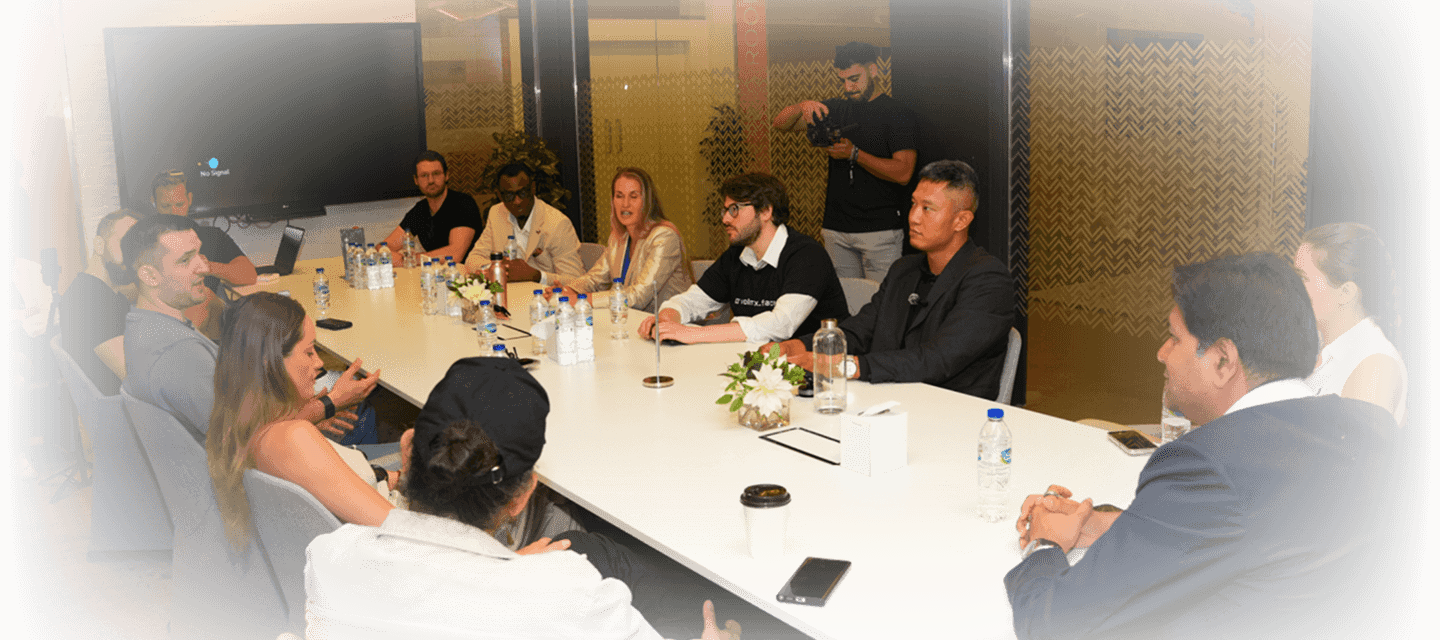

This Executive Roundtable convenes senior policymakers, banking leaders, fintech innovators, investors, and technology architects to collaboratively explore pathways for expanding digital payment adoption across diverse socio-economic landscapes.

FintechValuationsin2025:NavigatingMarketCorrections&RealisticPricing

The fintech sector has witnessed unprecedented growth in the past decade, fuelled by capital inflows, disruptive innovation, and a rapidly expanding customer base. However, 2025 has brought a more tempered, reality-driven investment climate, marked by valuation corrections, regulatory scrutiny, and shifting investor expectations

This Executive Roundtable convenes leading investors, fintech founders, financial analysts, policymakers, and strategic advisors to critically assess the state of fintech valuations. Together, we will explore how to move from inflated pricing models towards grounded, performance-based valuation frameworks that reflect long-term sustainability.

IndiaStackOpportunities:BuildingonUPI's$990BMarketPotential

The success of UPI has positioned India as a global benchmark for digital payments – with transactions exceeding $990 billion annually and reshaping how individuals, businesses, and governments exchange value. Yet UPI is just the beginning.

The India Stack – a unified, open, and interoperable set of APIs including Aadhaar, e-KYC, e-Sign, DigiLocker, and Account Aggregator – is unlocking entirely new possibilities for digital identity, seamless onboarding, credit access, e-governance, and cross-border innovations.

Bank-FintechPartnerships:CreatingWin-WinCollaborationModels

The convergence of traditional banking institutions and innovative fintech companies is one of the most transformative forces in today's financial sector. Banks bring trust, regulatory expertise, and deep customer bases. Fintechs bring agility, cutting-edge technology, and the ability to deliver seamless digital experiences.

When these strengths combine effectively, they can unlock new products, expanded market reach, and improved financial inclusion – while maintaining compliance and customer trust.

BuildingIndia'sSustainableDigitalFinancialEcosystem2030:AMulti-StakeholderBlueprintforInclusiveGrowth

India stands at the threshold of a decade that will define its leadership in digital finance, sustainable innovation, and equitable economic growth. By 2030, the nation's financial ecosystem will need to be digitally advanced, climate-resilient, and socially inclusive – serving urban, rural, and underserved populations with equal efficiency.

The vision for this roundtable is to convene public and private sector leaders, regulators, global development institutions, technology innovators, and sustainability experts to co-create a shared blueprint for building an ecosystem that thrives on responsible innovation, environmental stewardship, and inclusive growth.

AssetAllocators,PE,FamilyOffices&InstitutionalInvestorsShapingIndia'sFintechFuture

India's fintech sector has matured from being innovation-led to becoming investment-driven. As the ecosystem scales, the nature and direction of capital inflows will be a key determinant of its long-term sustainability, global competitiveness, and governance standards.

Private equity firms, family offices, institutional investors, and sovereign funds are no longer just funding the future – they are actively shaping market priorities, influencing regulatory direction, and determining the pace of consolidation in fintech.

CONTACT

Reach Out - We're Ready to Connect